This market brief is an overview of the week ahead and some of the events we see as being important to the markets.

Please be aware that our views may change throughout the course of the week, and we do not publish updates of such changes. For up-to-the-minute market analysis see our live trading room.

INDICES

AUSTRALASIA

ASX – 8232 (+90 or +1.11%)

The AU200 shows a strong bullish move, rising by 90 points this week, indicating solid upward momentum.

VOLATILITY ALERTS:

Tue 09:00 – AUD Judo Bank Manufacturing PMI (Sep)

Tue 11:30 – AUD Retail Sales MoM (Aug)

Thu 11:30 – AUD Balance of Trade (Aug)

For a move to the upside, we must now see this market close above 8252. Should this occur, we will look for a move into 8273, and if the upside momentum is strong, we could see a move higher into 8293 and potentially 8335.

If we cannot close above 8212, we could see a move back to test 8192 before a pause to the downside. A break below this level may result in a sharp move lower into 8172, and any further breaks to the downside may see a bigger move into 8130.

EUROPE

DAX (30) – 19425 (+683 or +3.64%)

The DAX30 shows a strong upward move, gaining 683 points this week, indicating solid bullish momentum.

VOLATILITY ALERTS:

Mon 19:00 – EUR Inflation Rate YoY (Sep)

Tue 17:15 – EUR HCOB Manufacturing PMI (Sep)

Wed 18:00 – EUR Unemployment Rate (Aug)

For a move to the upside, we must now see this market close above 19473. Should this occur, we will look for a move into 19522, and if the upside momentum is strong, we could see a move higher into 19569 and potentially 19668.

If we cannot close above 19376, we could see a move back to test 19327 before a pause to the downside. A break below this level may result in a sharp move lower into 19280, and any further breaks to the downside may see a bigger move into 19181.

US

S&P 500 – 5747 (+38 or +0.67%)

The US500 saw a moderate upward move this week, gaining strength with a 38-point rise, indicating a steady bullish trend.

VOLATILITY ALERTS:

Tue 03:55 – USD Fed Chair Powell Speech

Wed 00:00 – USD ISM Manufacturing PMI (Sep)

Thu 22:30 – USD Initial Jobless Claims (Sep/28)

For a move to the upside, we must now see this market close above 5761. Should this occur, we will look for a move into 5775, and if the upside momentum is strong, we could see a move higher into 5789 and potentially 5819.

If we cannot close above 5732, we could see a move back to test 5717 before a pause to the downside. A break below this level may result in a sharp move lower into 5703, and any further breaks to the downside may see a bigger move into 5673.

FOREX

AUD/USD – 0.915 (+109 or +1.6%)

The AUD/USD shows a solid upward move this week, gaining strength with a significant rise from 0.6806 to 0.6915.

VOLATILITY ALERTS:

Tue 09:00 – AUD Judo Bank Manufacturing PMI (Sep)

Tue 11:30 – AUD Retail Sales MoM (Aug)

Thu 11:30 – AUD Balance of Trade (Aug)

Tue 03:55 – USD Fed Chair Powell Speech

Wed 00:00 – USD ISM Manufacturing PMI (Sep)

Thu 22:30 – USD Initial Jobless Claims (Sep/28)

For a move to the upside, we must now see this market close above 0.6932. Should this occur, we will look for a move into 0.6949, and if the upside momentum is strong, we could see a move higher into 0.6966 and potentially 0.7002.

If we cannot close above 0.6897, we could see a move back to test 0.6880 before a pause to the downside. A break below this level may result in a sharp move lower into 0.6863, and any further breaks to the downside may see a bigger move into 0.6827.

EUR/USD – 1.1169 (+7 or +0.06%)

EURUSD shows a weak upward trend this week, with minimal movement from 1.1162 to 1.1169, indicating limited momentum.

VOLATILITY ALERTS:

Mon 19:00 – EUR Inflation Rate YoY (Sep)

Tue 17:15 – EUR HCOB Manufacturing PMI (Sep)

Wed 18:00 – EUR Unemployment Rate (Aug)

Tue 03:55 – USD Fed Chair Powell Speech

Wed 00:00 – USD ISM Manufacturing PMI (Sep)

Thu 22:30 – USD Initial Jobless Claims (Sep/28)

For a move to the upside, we must now see this market close above 1.1174. Should this occur, we will look for a move into 1.1184, and if the upside momentum is strong, we could see a move higher into 1.1194 and potentially 1.1204.

If we cannot close above 1.1164, we could see a move back to test 1.1154 before a pause to the downside. A break below this level may result in a sharp move lower into 1.1144, and any further breaks to the downside may see a bigger move into 1.1134.

GBP/USD – 1.3380 (+63 or +0.47%)

The GBP/USD is showing strong upward momentum this week, with a notable increase of 63 pips, signalling bullish sentiment.

VOLATILITY ALERTS:

Tue 18:30 – GBP S&P Global Manufacturing PMI (Sep)

Thu 18:30 – GBP S&P Global Services PMI (Sep)

Tue 03:55 – USD Fed Chair Powell Speech

Wed 00:00 – USD ISM Manufacturing PMI (Sep)

Thu 22:30 – USD Initial Jobless Claims (Sep/28)

For a move to the upside, we must now see this market close above 1.3405. Should this occur, we will look for a move into 1.3430, and if the upside momentum is strong, we could see a move higher into 1.3455 and potentially 1.3505.

If we cannot close above 1.3355, we could see a move back to test 1.3325 before a pause to the downside. A break below this level may result in a sharp move lower into 1.3305, and any further breaks to the downside may see a bigger move into 1.3255.

USD/JPY – 142.75 (-115 or -0.8%)

The USDJPY is trending downward, showing a notable decline of 1.15, indicating strong bearish momentum in the market.

VOLATILITY ALERTS:

Wed 09:50 – JPY Tankan Large Manufacturers Index (Q3)

Wed 15:00 – JPY Consumer Confidence (Sep)

Tue 03:55 – USD Fed Chair Powell Speech

Wed 00:00 – USD ISM Manufacturing PMI (Sep)

Thu 22:30 – USD Initial Jobless Claims (Sep/28)

For a move to the upside, we must now see this market close above 143.35. Should this occur, we will look for a move into 144.00, and if the upside momentum is strong, we could see a move higher into 144.65 and potentially 145.34.

If we cannot close above 142.15, we could see a move back to test 141.75 before a pause to the downside. A break below this level may result in a sharp move lower into 141.10, and any further breaks to the downside may see a bigger move into 140.50.

COMMODITIES

GOLD – 2662 (+42 or +1.6%)

Gold is trending strongly upwards with a significant move of 42 points this week, indicating robust bullish momentum.

For a move to the upside, we must now see this market close above 2665.5. Should this occur, we will look for a move into 2671.0, and if the upside momentum is strong, we could see a move higher into 2676.5 and potentially 2683.5.

If we cannot close above 2658.0, we could see a move back to test 2653.5 before a pause to the downside. A break below this level may result in a sharp move lower into 2649.0, and any further breaks to the downside may see a bigger move into 2640.0.

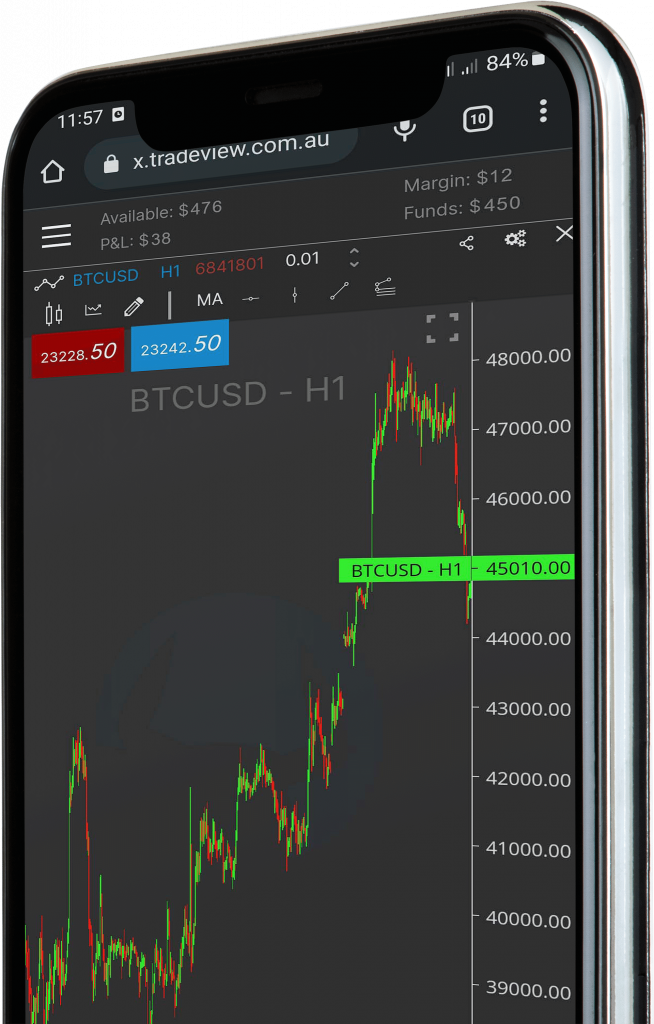

CRYPTOS

BITCOIN – 65500 (+2010 or +3.17%)

Bitcoin is surging with a strong upward momentum, jumping from 63,490 to 65,500.

For a move to the upside, we must now see this market close above 63538. Should this occur, we will look for a move into 63745, and if the upside momentum is strong, we could see a move higher into 63953 and potentially 64073.

If we cannot close above 63443, we could see a move back to test 63245 before a pause to the downside. A break below this level may result in a sharp move lower into 63036, and any further breaks to the downside may see a bigger move into 62888.