This market brief is an overview of the week ahead and some of the events we see as being important to the markets.

Please be aware that our views may change throughout the course of the week, and we do not publish updates of such changes. For up-to-the-minute market analysis see our live trading room.

INDICES

AUSTRALASIA

ASX – 8188 (-44 or -0.53%)

The AU200 has seen a moderate decline from 8232 to 8188, indicating a weak bearish trend this week.

VOLATILITY ALERTS:

Tue 10:30 – AUD RBA Meeting Minutes

Tue 10:30 – AUD NAB Business Confidence (Sep)

Wed 09:30 – AUD Westpac Consumer Confidence Change (Oct)

For a move to the upside, we must now see this market close above 8207. Should this occur, we will look for a move into 8229, and if the upside momentum is strong, we could see a move higher into 8251 and potentially 8289.

If we cannot close above 8168, we could see a move back to test 8146 before a pause to the downside. A break below this level may result in a sharp move lower into 8124, and any further breaks to the downside may see a bigger move into 8086.

EUROPE

DAX (30) – 19227 (-198 or -1.02%)

The DAX30 has experienced a significant drop from 19425 to 19227, indicating a strong bearish move this week.

VOLATILITY ALERTS:

Mon 19:00 – EUR Retail Sales MoM (Aug)

Mon 19:00 – EUR Retail Sales YoY (Aug)

Wed 16:00 – EUR Balance of Trade (Aug)

For a move to the upside, we must now see this market close above 19275. Should this occur, we will look for a move into 19323, and if the upside momentum is strong, we could see a move higher into 19371 and potentially 19467.

If we cannot close above 19179, we could see a move back to test 19131 before a pause to the downside. A break below this level may result in a sharp move lower into 19083, and any further breaks to the downside may see a bigger move into 18987.

US

S&P 500 – 5762 (+15 or +0.26%)

The US500 has made a slight increase from 5747 to 5762, indicating a weak bullish trend this week.

VOLATILITY ALERTS:

Thu 04:00 – USD FOMC Minutes

Thu 22:30 – USD CPI s.a (Sep)

Thu 22:30 – USD Core Inflation Rate YoY (Sep)

For a move to the upside, we must now see this market close above 5776. Should this occur, we will look for a move into 5790, and if the upside momentum is strong, we could see a move higher into 5804 and potentially 5834.

If we cannot close above 5748, we could see a move back to test 5734 before a pause to the downside. A break below this level may result in a sharp move lower into 5720, and any further breaks to the downside may see a bigger move into 5690.

FOREX

AUD/USD – 0.6798 (-117 or -1.69%)

The AUD/USD has seen a notable decline this week, with a moderate move to the downside, indicating bearish momentum.

VOLATILITY ALERTS:

Tue 10:30 – AUD RBA Meeting Minutes

Tue 10:30 – AUD NAB Business Confidence (Sep)

Wed 09:30 – AUD Westpac Consumer Confidence Change (Oct)

Thu 04:00 – USD FOMC Minutes

Thu 22:30 – USD CPI s.a (Sep)

Thu 22:30 – USD Core Inflation Rate YoY (Sep)

For a move to the upside, we must now see this market close above 0.6815. Should this occur, we will look for a move into 0.6833, and if the upside momentum is strong, we could see a move higher into 0.6850 and potentially 0.6883.

If we cannot close above 0.6781, we could see a move back to test 0.6763 before a pause to the downside. A break below this level may result in a sharp move lower into 0.6745, and any further breaks to the downside may see a bigger move into 0.6712.

EUR/USD – 1.0966 (-203 or -1.82%)

EURUSD is trending lower with a notable drop from 1.1169 to 1.0966, indicating strong bearish momentum this week.

VOLATILITY ALERTS:

Mon 19:00 – EUR Retail Sales MoM (Aug)

Mon 19:00 – EUR Retail Sales YoY (Aug)

Wed 16:00 – EUR Balance of Trade (Aug)

Thu 04:00 – USD FOMC Minutes

Thu 22:30 – USD CPI s.a (Sep)

Thu 22:30 – USD Core Inflation Rate YoY (Sep)

For a move to the upside, we must now see this market close above 1.0992. Should this occur, we will look for a move into 1.1028, and if the upside momentum is strong, we could see a move higher into 1.1059 and potentially 1.1083.

If we cannot close above 1.0940, we could see a move back to test 1.0916 before a pause to the downside. A break below this level may result in a sharp move lower into 1.0885, and any further breaks to the downside may see a bigger move into 1.0841.

GBP/USD – 1.3112 (-268 or -2%)

The GBP/USD has declined significantly this week, indicating a strong bearish trend as it moves lower from 1.3380 to 1.3112.

VOLATILITY ALERTS:

Tue 09:01 – GBP BRC Retail Sales Monitor YoY (Sep)

Fri 16:00 – GBP Goods Trade Balance (Aug)

Fri 16:00 – GBP GDP MoM (Aug)

Thu 04:00 – USD FOMC Minutes

Thu 22:30 – USD CPI s.a (Sep)

Thu 22:30 – USD Core Inflation Rate YoY (Sep)

For a move to the upside, we must now see this market close above 1.3135. Should this occur, we will look for a move into 1.3162, and if the upside momentum is strong, we could see a move higher into 1.3189 and potentially 1.3216.

If we cannot close above 1.3087, we could see a move back to test 1.3062 before a pause to the downside. A break below this level may result in a sharp move lower into 1.3035, and any further breaks to the downside may see a bigger move into 1.3089.

USD/JPY – 149.06 (+631 or +4.42%)

The USDJPY is soaring, jumping significantly from 142.75 to 149.06, indicating strong bullish momentum and a powerful upward trend!

VOLATILITY ALERTS:

Thu 04:00 – USD FOMC Minutes

Thu 22:30 – USD CPI s.a (Sep)

Thu 22:30 – USD Core Inflation Rate YoY (Sep)

For a move to the upside, we must now see this market close above 149.42. Should this occur, we will look for a move into 149.99, and if the upside momentum is strong, we could see a move higher into 150.56 and potentially 151.87.

If we cannot close above 148.69, we could see a move back to test 148.12 before a pause to the downside. A break below this level may result in a sharp move lower into 147.55, and any further breaks to the downside may see a bigger move into 146.24.

COMMODITIES

GOLD – 2650 (-12 or -0.45%)

Gold is trending downwards with a moderate move, closing this week at 2650, reflecting a slight bearish sentiment.

For a move to the upside, we must now see this market close above 2656. Should this occur, we will look for a move into 2663, and if the upside momentum is strong, we could see a move higher into 2668 and potentially 2678.

If we cannot close above 2643, we could see a move back to test 2645 before a pause to the downside. A break below this level may result in a sharp move lower into 2637, and any further breaks to the downside may see a bigger move into 2628.

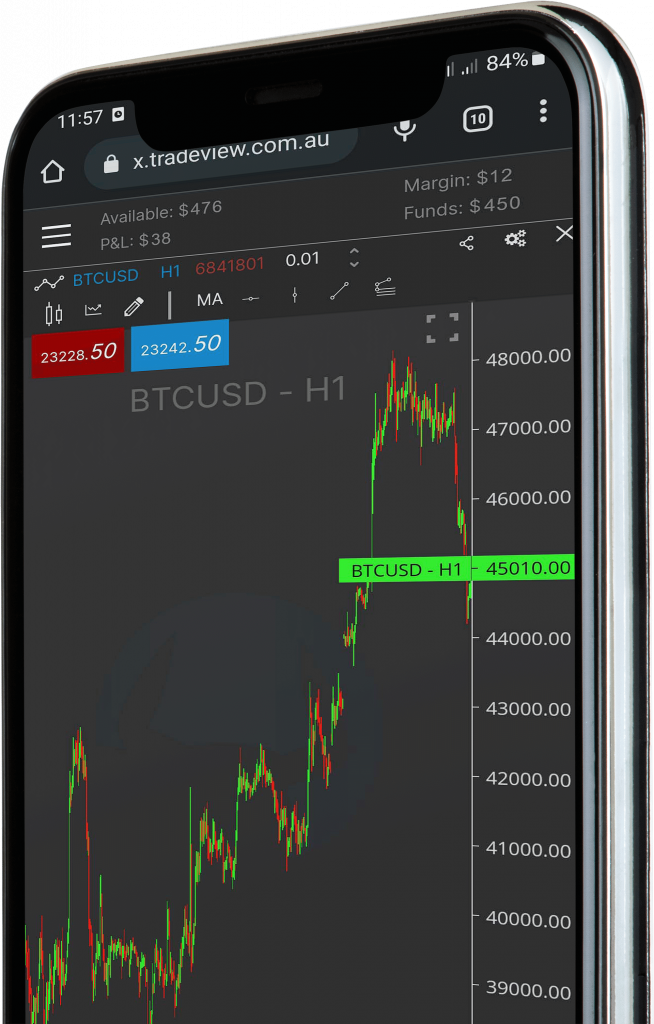

CRYPTOS

BITCOIN – 62373 (-3127 or -4.77%)

Bitcoin is trending downward with notable momentum, sliding from 65,500 to 62,373.

For a move to the upside, we must now see this market close above 62,878. Should this occur, we will look for a move into 63,383, and if the upside momentum is strong, we could see a move higher into 63,888 and potentially 64,276.

If we cannot close above 62,878, we could see a move back to test 62,473 before a pause to the downside. A break below this level may result in a sharp move lower into 61,978, and any further breaks to the downside may see a bigger move into 61,619.