This market brief is an overview of the week ahead and some of the events we see as being important to the markets.

Please be aware that our views may change throughout the course of the week, and we do not publish updates of such changes. For up-to-the-minute market analysis see our live trading room.

INDICES

AUSTRALASIA

ASX – 8253 (+65 or +0.79%)

The AU200 shows a moderate upward trend this week, rising from 8188 to 8253, indicating steady bullish momentum.

VOLATILITY ALERTS:

Thu 11:30 – AUD Unemployment Rate (Sep)

Thu 11:30 – AUD Employment Change (Sep)

Thu 11:30 – AUD Retail Sales MoM (Sep)

For a move to the upside, we must now see this market close above 8274. Should this occur, we will look for a move into 8294, and if the upside momentum is strong, we could see a move higher into 8315 and potentially 8356.

If we cannot close above 8232, we could see a move back to test 8211 before a pause to the downside. A break below this level may result in a sharp move lower into 8191, and any further breaks to the downside may see a bigger move into 8150.

EUROPE

DAX (30) – 19356 (+129 or +0.67%)

The DAX30 is showing a slight upward trend this week, rising from 19227 to 19356, indicating modest bullish movement.

VOLATILITY ALERTS:

Tue 20:00 – EUR ZEW Economic Sentiment Index (Oct)

Thu 23:15 – EUR ECB Interest Rate Decision

Thu 23:45 – EUR ECB Press Conference

For a move to the upside, we must now see this market close above 19385. Should this occur, we will look for a move into 19453, and if the upside momentum is strong, we could see a move higher into 19521 and potentially 19600.

If we cannot close above 19327, we could see a move back to test 19259 before a pause to the downside. A break below this level may result in a sharp move lower into 19191, and any further breaks to the downside may see a bigger move into 19112.

US

S&P 500 – 5818 (+56 or +0.97%)

The US500 is showing a moderate upward trend this week, rising from 5762 to 5818, reflecting steady bullish movement.

VOLATILITY ALERTS:

Tue 23:30 – USD NY Empire State Manufacturing Index (Oct)

Thu 23:30 – USD Initial Jobless Claims (Oct/12)

Thu 23:30 – USD Retail Sales YoY (Sep)

For a move to the upside, we must now see this market close above 5832. Should this occur, we will look for a move into 5847, and if the upside momentum is strong, we could see a move higher into 5861 and potentially 5889.

If we cannot close above 5803, we could see a move back to test 5788 before a pause to the downside. A break below this level may result in a sharp move lower into 5773, and any further breaks to the downside may see a bigger move into 5745.

FOREX

AUD/USD – 0.6735 (-63 or -0.93%)

The AUDUSD is trending lower with a moderate decline, indicating a bearish move from 0.6798 to 0.6735 this week.

VOLATILITY ALERTS:

Thu 11:30 – AUD Unemployment Rate (Sep)

Thu 11:30 – AUD Employment Change (Sep)

Thu 11:30 – AUD Retail Sales MoM (Sep)

Tue 23:30 – USD NY Empire State Manufacturing Index (Oct)

Thu 23:30 – USD Initial Jobless Claims (Oct/12)

Thu 23:30 – USD Retail Sales YoY (Sep)

For a move to the upside, we must now see this market close above 0.6752. Should this occur, we will look for a move into 0.6769, and if the upside momentum is strong, we could see a move higher into 0.6785 and potentially 0.6819.

If we cannot close above 0.6717, we could see a move back to test 0.6700 before a pause to the downside. A break below this level may result in a sharp move lower into 0.6683, and any further breaks to the downside may see a bigger move into 0.6649.

EUR/USD – 1.0930 (-36 or -0.33%)

The EURUSD is trending slightly lower this week with a moderate decline, indicating a weak bearish movement from last week.

VOLATILITY ALERTS:

Tue 20:00 – EUR ZEW Economic Sentiment Index (Oct)

Thu 23:15 – EUR ECB Interest Rate Decision

Thu 23:45 – EUR ECB Press Conference

Tue 23:30 – USD NY Empire State Manufacturing Index (Oct)

Thu 23:30 – USD Initial Jobless Claims (Oct/12)

Thu 23:30 – USD Retail Sales YoY (Sep)

For a move to the upside, we must now see this market close above 1.0953. Should this occur, we will look for a move into 1.0980, and if the upside momentum is strong, we could see a move higher into 1.0998 and potentially 1.1053.

If we cannot close above 1.0908, we could see a move back to test 1.0905 before a pause to the downside. A break below this level may result in a sharp move lower into 1.0855, and any further breaks to the downside may see a bigger move into 1.0805.

GBP/USD – 1.3054 (-58 or -0.44%)

The GBP/USD is trending downward, with a notable move as it dropped 58 pips, indicating weakness in the pair.

VOLATILITY ALERTS:

Tue 17:00 – GBP Unemployment Rate (Aug)

Tue 17:00 – GBP Employment Change (Aug)

Fri 17:00 – GBP Retail Sales YoY (Sep)

Tue 23:30 – USD NY Empire State Manufacturing Index (Oct)

Thu 23:30 – USD Initial Jobless Claims (Oct/12)

Thu 23:30 – USD Retail Sales YoY (Sep)

For a move to the upside, we must now see this market close above 1.3084. Should this occur, we will look for a move into 1.3104, and if the upside momentum is strong, we could see a move higher into 1.3129 and potentially 1.3179.

If we cannot close above 1.3029, we could see a move back to test 1.3004 before a pause to the downside. A break below this level may result in a sharp move lower into 1.2979, and any further breaks to the downside may see a bigger move into 1.2929.

USD/JPY – 149.26 (+20 or +0.13%)

The USDJPY shows a strong upward trend with a significant move this week, rising from 149.06 to 149.26.

VOLATILITY ALERTS:

Thu 10:50 – JPY Balance of Trade (Sep)

Fri 10:30 – JPY Inflation Rate YoY (Sep)

Tue 23:30 – USD NY Empire State Manufacturing Index (Oct)

Thu 23:30 – USD Initial Jobless Claims (Oct/12)

Thu 23:30 – USD Retail Sales YoY (Sep)

For a move to the upside, we must now see this market close above 149.39. Should this occur, we will look for a move into 149.79, and if the upside momentum is strong, we could see a move higher into 150.19 and potentially 150.42.

If we cannot close above 149.14, we could see a move back to test 148.79 before a pause to the downside. A break below this level may result in a sharp move lower into 148.39, and any further breaks to the downside may see a bigger move into 147.76.

COMMODITIES

GOLD – 2649 (-1 or -0.04%)

Gold is trending slightly bearish with a minimal decline, reflecting weak momentum as it moved down just one point.

For a move to the upside, we must now see this market close above 2651. Should this occur, we will look for a move into 2662, and if the upside momentum is strong, we could see a move higher into 2673 and potentially 2686.

If we cannot close above 2646, we could see a move back to test 2638 before a pause to the downside. A break below this level may result in a sharp move lower into 2628, and any further breaks to the downside may see a bigger move into 2616.

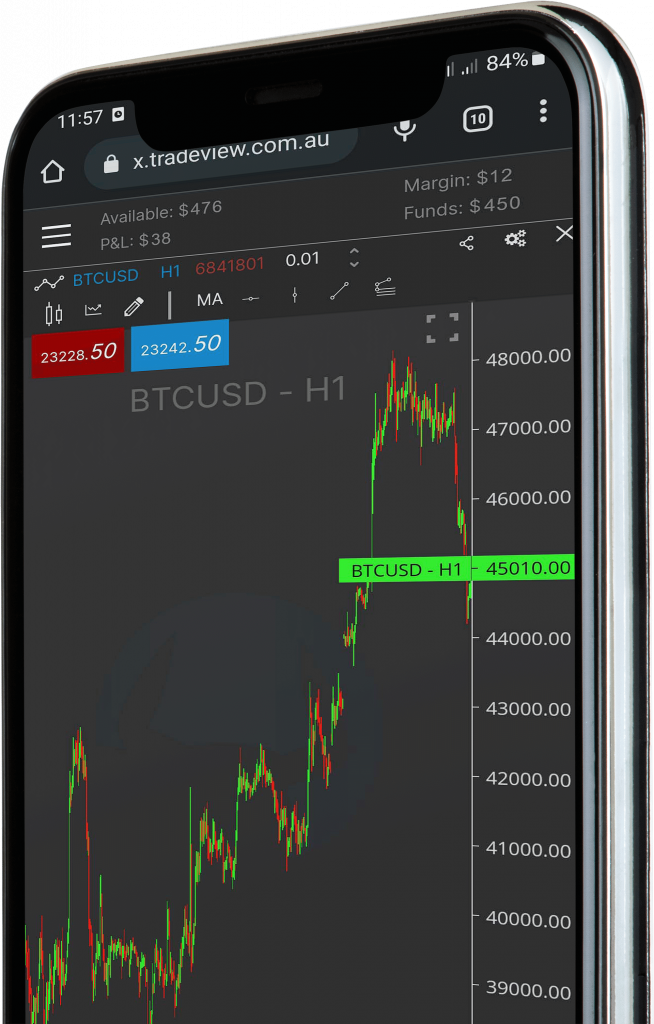

CRYPTOS

BITCOIN – 62702 (+329 or +0.53%)

Bitcoin is showing strong bullish momentum, climbing by 329 points this week, indicating positive market sentiment and upward momentum.

For a move to the upside, we must now see this market close above 62952. Should this occur, we will look for a move into 63102, and if the upside momentum is strong, we could see a move higher into 63252 and potentially 63427.

If we cannot close above 62477, we could see a move back to test 62302 before a pause to the downside. A break below this level may result in a sharp move lower into 62127, and any further breaks to the downside may see a bigger move into 61852.