This market brief is an overview of the week ahead and some of the events we see as being important to the markets.

Please be aware that our views may change throughout the course of the week, and we do not publish updates of such changes. For up-to-the-minute market analysis see our live trading room.

INDICES

AUSTRALASIA

ASX – 8338 (+85 or +1.03%)

The AU200 shows a moderate bullish trend, with a steady rise of 85 points from 8253 to 8338 this week.

VOLATILITY ALERTS:

Thu 09:00 – AUD Judo Bank Manufacturing PMI (Oct)

Thu 09:00 – AUD Judo Bank Services PMI (Oct)

For a move to the upside, we must now see this market close above 8358. Should this occur, we will look for a move into 8379, and if the upside momentum is strong, we could see a move higher into 8400 and potentially 8439.

If we cannot close above 8318, we could see a move back to test 8297 before a pause to the downside. A break below this level may result in a sharp move lower into 8277, and any further breaks to the downside may see a bigger move into 8237.

EUROPE

DAX (30) – 19672 (+316 or +1.63%)

The DAX30 shows a solid bullish move, gaining 316 points from 19356 to 19672, indicating strong upward momentum.

VOLATILITY ALERTS:

Wed 01:00 – EUR ECB President Lagarde Speech

Fri 19:00 – EUR Ifo Business Climate (Oct)

Fri 18:00 – EUR Unemployment Rate (Q3)

For a move to the upside, we must now see this market close above 19721. Should this occur, we will look for a move into 19770, and if the upside momentum is strong, we could see a move higher into 19819 and potentially 19918.

If we cannot close above 19623, we could see a move back to test 19574 before a pause to the downside. A break below this level may result in a sharp move lower into 19525, and any further breaks to the downside may see a bigger move into 19426.

US

S&P 500 – 5879 (+61 or +1.05%)

The US500 shows a moderate upward trend, gaining 61 points from 5818 to 5879, indicating steady bullish momentum.

VOLATILITY ALERTS:

Thu 23:30 – USD Continuing Jobless Claims (Oct/12)

Thu 23:30 – USD Initial Jobless Claims (Oct/19)

Fri 23:30 – USD Durable Goods Orders MoM (Sep)

For a move to the upside, we must now see this market close above 5893. Should this occur, we will look for a move into 5908, and if the upside momentum is strong, we could see a move higher into 5922 and potentially 5946.

If we cannot close above 5864, we could see a move back to test 5849 before a pause to the downside. A break below this level may result in a sharp move lower into 5835, and any further breaks to the downside may see a bigger move into 5810.

FOREX

AUD/USD – 0.6712 (-23 or -0.34%)

AUDUSD is trending slightly lower this week with a modest decline, showing a weak bearish movement from last week’s level.

VOLATILITY ALERTS:

Thu 09:00 – AUD Judo Bank Manufacturing PMI (Oct)

Thu 09:00 – AUD Judo Bank Services PMI (Oct)

Thu 23:30 – USD Continuing Jobless Claims (Oct/12)

Thu 23:30 – USD Initial Jobless Claims (Oct/19)

Fri 23:30 – USD Durable Goods Orders MoM (Sep)

For a move to the upside, we must now see this market close above 0.6728. Should this occur, we will look for a move into 0.6745, and if the upside momentum is strong, we could see a move higher into 0.6760 and potentially 0.6796.

If we cannot close above 0.6696, we could see a move back to test 0.6680 before a pause to the downside. A break below this level may result in a sharp move lower into 0.6664, and any further breaks to the downside may see a bigger move into 0.6628.

EUR/USD – 1.0867 (-63 or -0.58%)

EUR/USD is trending lower with a moderate decline, showing weakness as it moves from 1.0930 to 1.0867 this week.

VOLATILITY ALERTS:

Wed 01:00 – EUR ECB President Lagarde Speech

Fri 19:00 – EUR Ifo Business Climate (Oct)

Fri 18:00 – EUR Unemployment Rate (Q3)

Thu 23:30 – USD Continuing Jobless Claims (Oct/12)

Thu 23:30 – USD Initial Jobless Claims (Oct/19)

Fri 23:30 – USD Durable Goods Orders MoM (Sep)

For a move to the upside, we must now see this market close above 1.0880. Should this occur, we will look for a move into 1.0917, and if the upside momentum is strong, we could see a move higher into 1.0942 and potentially 1.0984.

If we cannot close above 1.0880, we could see a move back to test 1.0832 before a pause to the downside. A break below this level may result in a sharp move lower into 1.0812, and any further breaks to the downside may see a bigger move into 1.0779.

GBP/USD – 1.3052 (-2 or -0.02%)

The GBP/USD is showing a slight downward trend, indicating weakness with minimal movement this week.

VOLATILITY ALERTS:

Thu 19:30 – GBP S&P Global Services PMI (Oct)

Thu 19:30 – GBP S&P Global Manufacturing PMI (Oct)

Thu 23:30 – USD Continuing Jobless Claims (Oct/12)

Thu 23:30 – USD Initial Jobless Claims (Oct/19)

Fri 23:30 – USD Durable Goods Orders MoM (Sep)

For a move to the upside, we must now see this market close above 1.3080. Should this occur, we will look for a move into 1.3102, and if the upside momentum is strong, we could see a move higher into 1.3124 and potentially 1.3170.

If we cannot close above 1.3024, we could see a move back to test 1.3002 before a pause to the downside. A break below this level may result in a sharp move lower into 1.2979, and any further breaks to the downside may see a bigger move into 1.2922.

USD/JPY – 149.55 (+29 or +0.19%)

The USDJPY is showing strong upward momentum, rising from 149.26 to 149.55—a notable move indicating bullish strength!

VOLATILITY ALERTS:

Thu 23:30 – USD Continuing Jobless Claims (Oct/12)

Thu 23:30 – USD Initial Jobless Claims (Oct/19)

Fri 23:30 – USD Durable Goods Orders MoM (Sep)

For a move to the upside, we must now see this market close above 149.66. Should this occur, we will look for a move into 149.78, and if the upside momentum is strong, we could see a move higher into 149.91 and potentially 150.07.

If we cannot close above 149.43, we could see a move back to test 149.00 before a pause to the downside. A break below this level may result in a sharp move lower into 148.88, and any further breaks to the downside may see a bigger move into 148.73.

COMMODITIES

GOLD – 2723 (+74 or +2.79%)

Gold is trending strongly upward, with a significant move this week from 2649 to 2723, showcasing robust bullish momentum!

For a move to the upside, we must now see this market close above 2728. Should this occur, we will look for a move into 2738, and if the upside momentum is strong, we could see a move higher into 2748 and potentially 2773.

If we cannot close above 2728, we could see a move back to test 2718 before a pause to the downside. A break below this level may result in a sharp move lower into 2708, and any further breaks to the downside may see a bigger move into 2693.

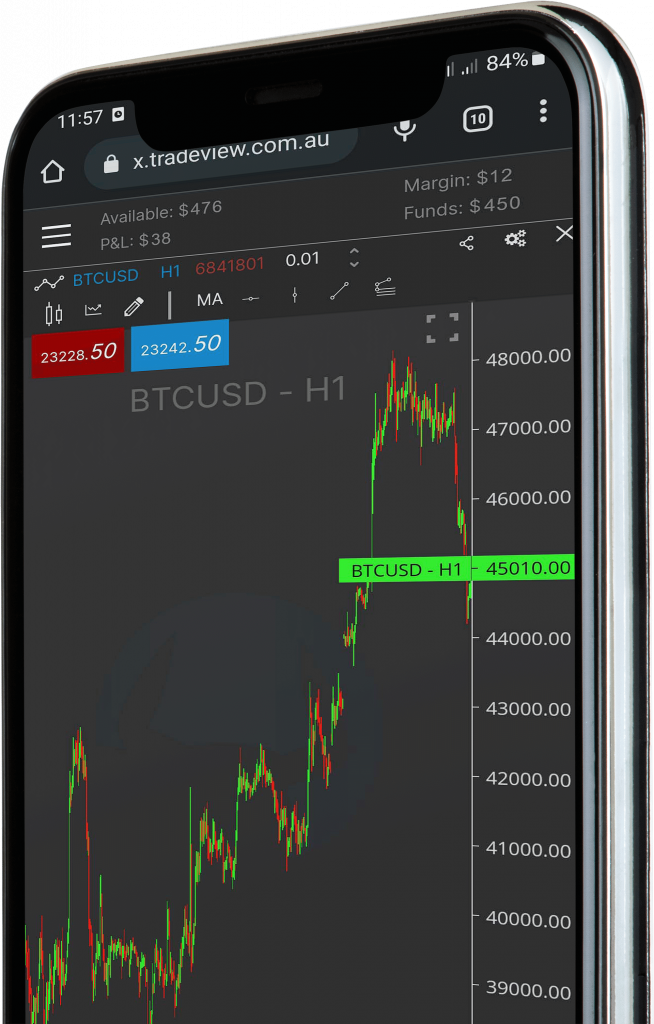

CRYPTOS

BITCOIN – 69080 (+6378 or +10.17%)

Bitcoin is experiencing a strong upward trend, surging by over 6,000 points this week—an exciting move for investors!

For a move to the upside, we must now see this market close above 69245. Should this occur, we will look for a move into 69530, and if the upside momentum is strong, we could see a move higher into 69615 and potentially 69810.

If we cannot close above 68815, we could see a move back to test 68730 before a pause to the downside. A break below this level may result in a sharp move lower into 68595, and any further breaks to the downside may see a bigger move into 68480.