Latest Market Stories

Cryptos, Craze, Crash and Chaos

The past month has seen heightened volatility across crypto assets. For example, we have seen average daily volatility of 13% in Bitcoin.

Behind some of the price, action has been Tesla and, in particular, their CEO Elon Musk. After being added to the balance sheet of Tesla and then allowing payments in the crypto, Mr Musk caused a dramatic fall in Bitcoin’s price after he U-turned on his decision, stating environmental reasons.

That has reinforced talk about the environmental impact of Bitcoin mining (something we talked about in last month’s letter) with China reaffirming their stance by cracking down on domestic mining. It has been reported that sudden selling also caused significant liquidation of leveraged accounts, with 775k accounts wiped out in 24 hours.

Even if you don’t believe in cryptos, it is large enough now to be paying attention to.

If I don’t trade them, why does it matter?

Firstly, whether you believe in the tech or not, they do provide traders with opportunities due to the volatility. As such, we build and trade systems on cryptos – they also provide a different asset class for portfolio diversification.

But where is the diversification coming from? Several studies lately suggest there may be a developing, positive relationship between crypto markets and equities. So, even if you don’t trade them, it does suggest that equity sentiment could become more coupled with Bitcoin for a temporary period of time – and given the recent market stresses in crypto, it may be worth keeping an eye on developments for all market participants.

‘Memestock’ Mania – is it back?

In the month of May, we saw the return of several ‘memestocks’ after a few months of a lull following January’s frenzy. Cinema group AMC entertainment posted gains of circa 150% while electronic gaming retailer GameStop was up 26%. Interestingly, this occurred while money poured out of Bitcoin, as just discussed.

The moves are mainly being driven by retail traders who are looking for quick, thrill-seeking profits and targeting the most ‘shorted’ stocks to cause squeezes similar to what we saw back in January. One day in the last week of May saw AMC call options volume almost greater than that of SPY (S&P 500 ETF) volume! It certainly looks like round 2 is here.

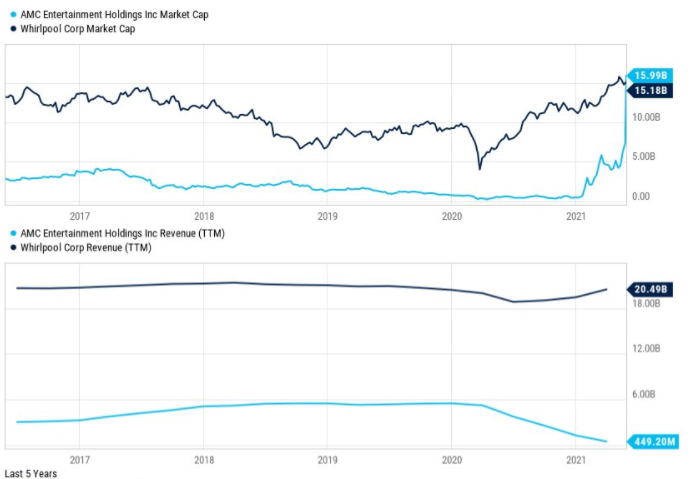

Below you have charts displaying both the market cap and revenue of two U.S. listed companies – AMC and Whirlpool.

At $16 billion, AMC’s market cap passed Whirlpool, a company with over $20 billion in revenues in the past year versus $449 million for AMC. AMC had it’s business destroyed by the Covid-19 pandemic as can be seen by the drop in revenue from 2020 onwards on the bottom chart.

But note the divergence to the market cap which has increased to $15bn in the same time period. Last year, AMC saw a drop off in revenues of $4.6bn – this means they only trade a price/loss ratio of 3.5x! Very cheap…

In fact – one day later and the above chart can be scrapped – at the time of writing AMC just posted a daily gain of 92% and now boasts a market cap of $33bn! This puts the yearly gain at a meagre 3000%. The CEO is riding the wave and enjoying social media communications – recently offering shareholders free popcorn (see below) – scrap the ‘diamond hands’ meme, it is now ‘popcorn hands’. Make no mistake, memestock mania is back – but is it different this time?

To continue reading this article…

This Newsletter is FREE to Trade View Clients.

If you are an existing client please LOG IN.

Our Monthly Newsletters

Unlimited access

A$9.90/mo.

No lock-in contracts.