Latest Market Stories

Earnings, Earnings and more Earnings

Q1 earnings season was arguably the most anticipated in quite a while. With talk of the big U.S. economic recovery following an impressive fast vaccine rollout, eyes have been on the performance of the big cap companies. Could they back up the narrative? So far, the answer has been a firm yes – they have mainly exceeded all expectations. Basically, if you want a reason to be bearish, these earnings have not been it.

The Financial sector enjoyed a particularly strong quarter with investment banks enjoying the euphoria surrounding capital markets. Even Deutsche Bank, usually lagging behind its American rivals, enjoyed its strongest quarter in 7 years. However, following on from last month’s letter where we discussed the Archegos Capital Management LLC scandal, the reporting showed collectively banks took an approximate $10bn hit – remarkable from just one fund. Heads have rolled at Credit Suisse who were hit the hardest taking around 40% of that hit themselves.

The big Tech constituents (Amazon, Apple, Microsoft, Facebook and Google) all smashed analysts expectations with the exception of Netflix, who weren’t able to get close to their record results from this time last year. It appears these small minority of companies can be a ‘stay-at-home’ AND a reopening play – helped by the fact they have been immune from supply chain bottlenecks and higher input prices.

Tesla and Bitcoin

So Tesla’s reporting proved to be the biggest talking point of the season, particularly the involvement of Bitcoin in their profit statement. It was shown that they banked just over $100m profit from buying then selling Bitcoin in March, representing almost a quarter of their total $400m net profit.

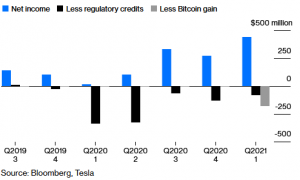

Regulatory credits already are a large proportion of the companies profits and now Bitcoin has been added to the mix:

Minus the $100m Bitcoin profit and subsidies/tax credits they actually lost $181m in the quarter. The $100m Bitcoin profit within a month is greater than the company’s profits on selling cars (ex. reg credits) over the past 12 years.

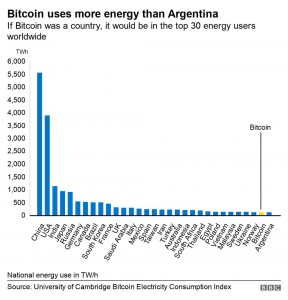

Tesla’s involvement with Bitcoin is interesting from many angles. Firstly, it is now known that Bitcoin has a negative environmental impact. In fact, its yearly energy consumption would be larger than in entire countries!

Tesla promotes itself upon its incredible technology as earth-saving. So combining the two seems a bit counter-intuitive – at least from a shareholders perspective – as Tesla has made more money from something destroying the planet than from saving it!

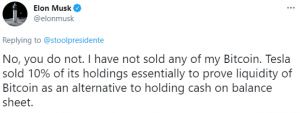

Secondly – Elon Musk pointed out in a tweet that he sold the Bitcoin ‘to prove liquidity’:

Well if that is the case, what stopped them from buying it back?

The main focus of Tesla should be on ensuring its record projections of 800,000 deliveries in the next quarter is achievable, as well as making it a profitable car manufacturing company.

To continue reading this article…

This Newsletter is FREE to Trade View Clients.

If you are an existing client please LOG IN.

Our Monthly Newsletters

Unlimited access

A$9.90/mo.

No lock-in contracts.