A slightly more challenging letter to write this month, as many of the market moves and stories related to the Ukraine and Russia conflicts, with an American research firm predicting there is a 10% chance of global nuclear war, market volatility could remain high.

Soaring Commodities

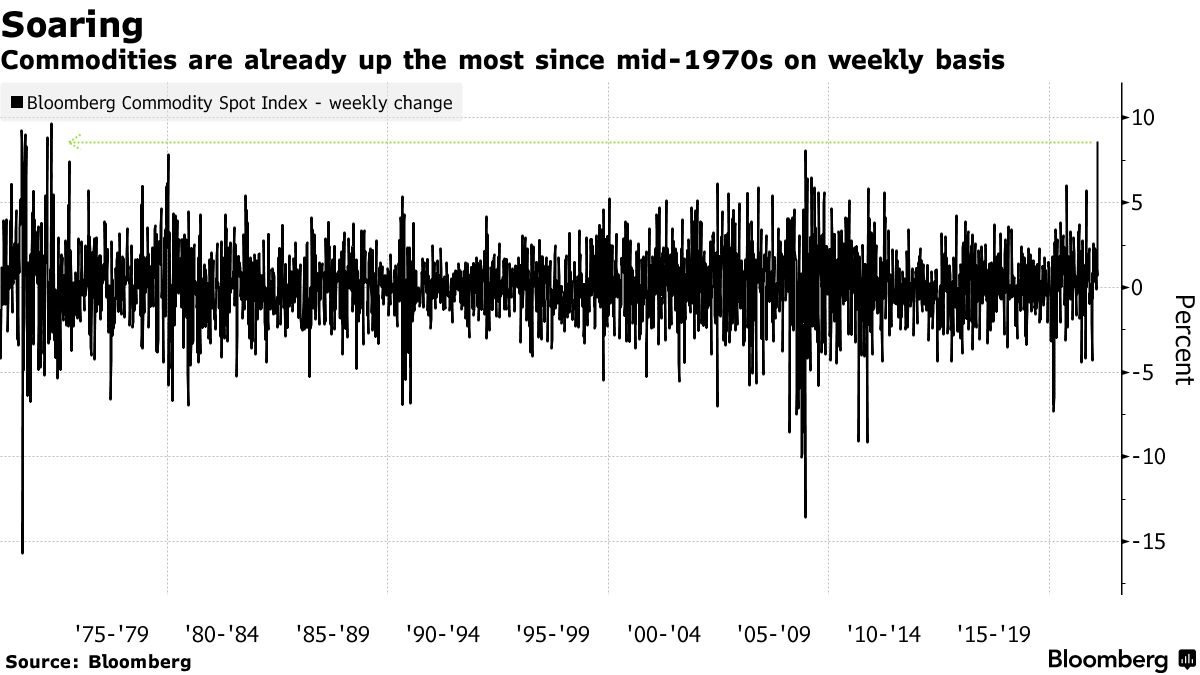

Commodities just posted their biggest weekly gain since 1960 – think Cold War, Vietnam War, Soviet Union and John F. Kennedy being elected as US president.

Here is a chart from Bloomberg showing the incredible weekly spike:

What has caused this commodities spike? Russia and Ukraine ship more than 25% of global wheat exports, a fifth of corn sales, a similar share for barley and 80% of sunflower oil cargoes. The war and the ensuing sweeping sanctions from the U.S. and Europe have sent the grain markets into turmoil.

Then there is oil, with Crude & Brent prices up ~20% for the week (ending 4th March) to levels not seen since 2009. The move has got analysts at JP Morgan suggesting we could even see $185 if Russian supply hits persist – currently 66% of Russian oil is struggling to find buyers.

This is one of the largest oil shocks ever: Russia’s supply shock via sanctions represents a 3 million barrels a day drop-in Russian crude and petroleum seaborne exports. The U.S and UK have now also banned Russian imports.

This is the 5th largest disruption since WWII. Despite all of this, OPEC+ decided to leave its schedule of production increases unchanged.

The situation in Ukraine is devastating with some tragic scenes and one we hope gets resolved as soon as possible, but markets will continue to move. Trading can be emotional at the best of times, let alone when there is a war unfolding. We want to re-emphasise the importance of trading using automation, as a method of controlling any emotion you may be feeling.

Here is an example of a set up and entry our professional breakout indicator took on Crude:

The entry was on the H1 breakout signal with an exit on the re-crossing of the 20 period MA. This trade would have netted a $10 move (approx 1000 points).

To continue reading this article…

This Newsletter is FREE to Trade View Clients.

If you are an existing client please LOG IN.

Our Monthly Newsletters

Unlimited access

A$9.90/mo.

No lock-in contracts.